In Crypto Currency We Trust - Unbanking the Banked

Tuesday, October 23, 2018

Wednesday, September 26, 2018

Bitcoin Mining Pools

Now that you have Bitcoin mining hardware, your next step is to join a Bitcoin mining pool.

Now that you have Bitcoin mining hardware, your next step is to join a Bitcoin mining pool.What is a Mining Pool?

Mining pools are groups of cooperating miners who agree to share block rewards in proportion to their contributed mining hash power.

While mining pools are desirable to the average miner as they smooth out rewards and make them more predictable, they unfortunately concentrate power to the mining pool’s owner.

Miners can, however, choose to redirect their hashing power to a different mining pool at anytime.

Pool Concentration in China

Before we get into the best mining pools to join, it’s important to note that most mining pools are in China. Many only have Chinese websites and support. Mining centralization in China is one of Bitcoin’s biggest issues at the moment.

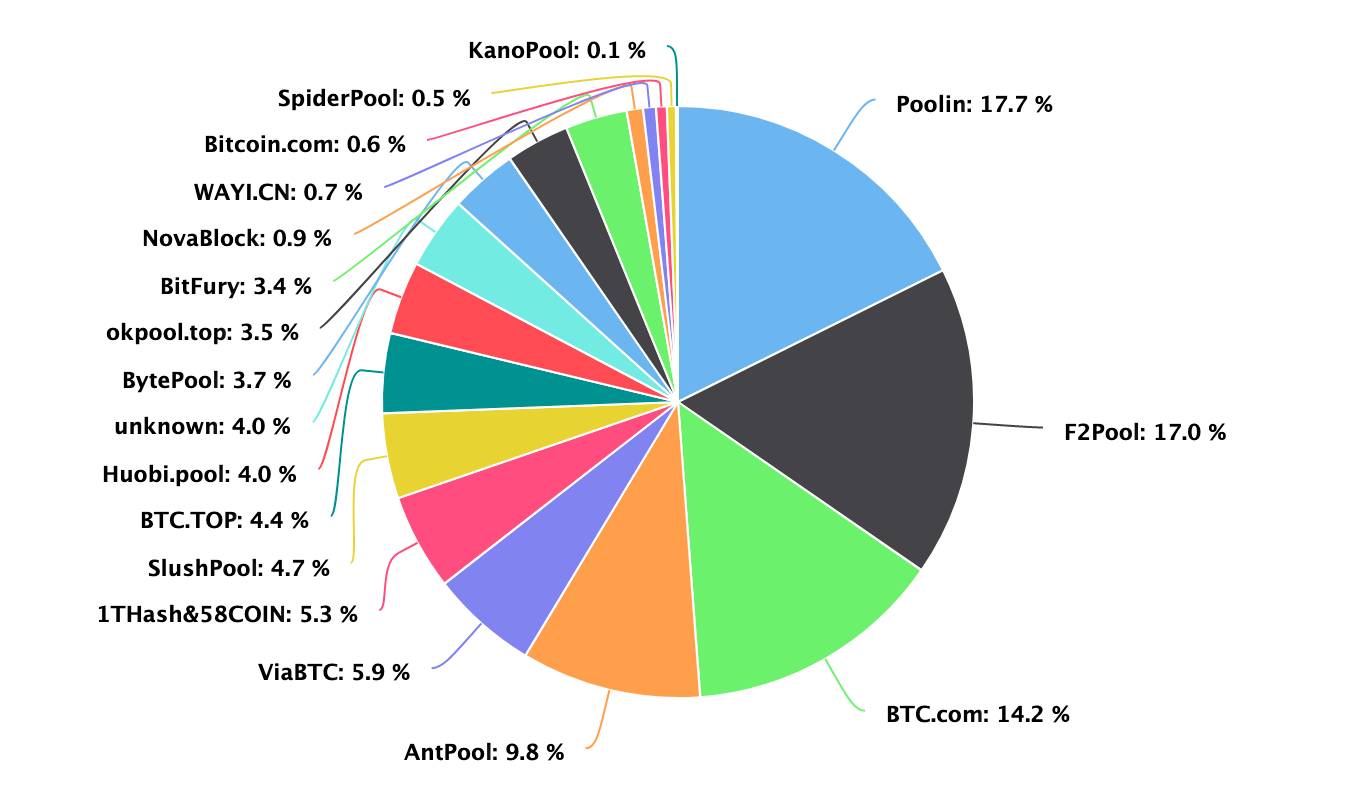

There are about 20 major mining pools. Broken down by the percent of hash power controlled by a pool, and the location of that pool’s company, we estimate that Chinese pools control ~81% of the network hash rate:

China - 81%

Czech Republic - 10%

Iceland - 2%

Japan - 2%

Georgia - 2%

Russia - 1%

The Biggest Mining Pools

The list below details the biggest Bitcoin mining pools. This is based on info from Blockchain’s pool share chart:

We strongly recommend new miners to join Slush Pool despite it not being one of the biggest pools. It was the first Bitcoin mining pool and remains one of the most reliable and trusted pools, especially for beginners.

1. BTC.com

BTC.com is a public mining pool that can be joined. However, we strongly recommend joining Slush Pool instead.

2. Antpool

Antpool is a mining pool based in China and owned by BitMain. Antpool mines about 25% of all blocks.

3. ViaBTC

ViaBTC is a somewhat new mining pool that has been around for about one year. It’s targeted towards Chinese miners.

4. Slush

Slush was the first mining pool and currently mines about 3% of all blocks.

Slush is probably one of the best and most popular mining pools despite not being one of the largest.

5. F2pool

DiscusFish, also known as F2Pool, is based in China. F2Pool has mined about 5-6% of all blocks over the past six months.

6. BTC.top

BTC.top is a private pool and cannot be joined.

7. Bitclub.Network

Bitclub Network is a large mining pool but appears to be somewhat shady. We recommend staying away from this pool.

8. BTCC

BTCC is a pool and also China’s third largest Bitcoin exchange. Its mining pool currently mines about 7% of all blocks.

9. Bitfury

Bitfury is a private pool that cannot be joined. Bitfury currently mines about 2% of all blocks.

10. BW Pool

BW, established in 2014, is another mining company based in China. It currently mines about 2% of all blocks.

Bitcoin Mining Pool Comparison

| Pool | Location | Fees | Private Pool |

|---|---|---|---|

| BitFury | Georgia | 0% | Yes |

| BTCC | China | 2-3% | No |

| Slush Pool | Czech Republic | 2% | No |

| Antpool | China | 1% | No |

| BW | China | 1% | No |

The comparison chart above is just a quick reference. The location of a pool does not matter all that much. Most of the pools have servers in every country so even if the mining pool is based in China, you could connect to a server in the US, for example.

Get a Bitcoin Wallet and Mining Software

Before you join a mining pool you will also need Bitcoin mining software and a Bitcoin wallet.

Mining Pools vs Cloud Mining

Many people read about mining pools and think it is just a group that pays out free bitcoins. This is not true! Mining pools are for people who have mining hardware to split profits.

Many people get mining pools confused with cloud mining. Cloud mining is where you pay a service provider to miner for you and you get the rewards.

Friday, September 21, 2018

The need for speed Elixxir

One of the founders of the cypherpunk movement has just revealed new technology that he believes will revolutionize cryptocurrency from this moment on.

Revealed exclusively to CoinDesk, the grey-haired, digital money pioneer David Chaum is launching a new cryptocurrency Elixxir via his startup.

And his goals are bold. By using cryptographic techniques he invented decades ago, he believes he's "reinvented" cryptocurrency, fixing fundamental problems plaguing the emerging technology, including speed, privacy, scalability and – one that perhaps doesn't get quite as much attention – resistance to future disasters.

Even further, he thinks solving these problems will take blockchain "mainstream."

One of the most influential digital money pioneers leading up to bitcoin, the famed cryptographer has been sleuthing around cryptocurrency conferences recently – dropping hints here and there – sparking theories about what exactly he's been up to.

What he found, though, were many problems with the tech.

Not least of all that it takes upwards of an hour to send a secure payment, which is not at all competitive with PayPal, Visa or other major digital payment systems.

"Yeah, it's not really suitable for widespread use," Chaum told CoinDesk.

But using his more than 30 years of experience working with cryptography and payments, including developing anonymous digital money eCash before even the internet existed, he thinks he's found a new way to solve these problems.

"I think we can shoot these problems dead," Chaum told CoinDesk, adding:

"It's no bullshit. We have code running in our lab."

Claimed breakthroughs

The cryptographer claims to have made two blockchain breakthroughs.

One is to change digital signatures, a crucial cryptographic component of cryptocurrency, used to verify whether someone owns the cryptocurrency they say they do.

According to Chaum, the way digital signatures are computed in most cryptocurrencies today is just a hassle. These signatures are just too computationally expensive as is, Chaum contends.

"There's no way we can get speed and scalability if for every transaction a server has to do a public key operation like making a signature or checking a signature," he said.

So, Elixxir changes it up a bit.

"We can cheat a little bit," Chaum said.

Arguing that the system could carry out these public key operations "in advance," Chaum explained that by doing this, Elixxir is no less than a thousand times faster than any other blockchain.

"It's a breakthrough. No one else does anything like it," he added.

The public key cryptography used in Elixxir has another impact as well – it futureproofs the cryptocurrency for the era of quantum computers. Currently, most cryptocurrencies architecture leaves them vulnerable to quantum computers.

And while this technology is likely still a long way from release, Chaum thinks this is such an important notion that he argues governments should be spending time on making sure digital money is quantum resistant.

One honest person

Then there's the privacy of Elixxir – arguably Chaum's forte, as he's known as the "father of online anonymity."

Within the Elixxir architecture, Chaum believes "true privacy" can be achieved through so-called "multi-party computations" – a term he coined decades ago and a feature that's used for enhanced privacy in cryptocurrency projects like Zcash and Enigma.

The gist of the system is that a bunch of developers or nodes are involved in a cryptocurrency computation, but only one person needs to be honest in order for the computation to work and for the data to stay private.

Elixxir uses this idea in a novel way. The nodes on the network, called "Mixnodes," produce a multi-party computation for every block of transactions.

Chaum compares this process to a group of people sitting around a card table. Each cuts the deck and shuffles, passing it to the next person. Say three of them are card sharks who know how to shuffle in a way that helps them to determine the location of the cards in the deck.

But if just one of these people is honest and shuffles sufficiently, the card sharks, in the end, are "completely in the dark," Chaum said.

He continued:

"Despite their best efforts to collude, and you know make notes of exactly what they do and everything, they are powerless against the one party that actually does what they're supposed to."

And in this way, Elixxir privatizes transactions.

Skepticism, everywhere

What brought Chaum to build Elixxir was suspicion and apprehension about the state of the cryptocurrency industry today.

"In this space, there are a lot of unfounded claims being made," he told CoinDesk.

"People bend the rules. They try to present things in a way that makes them look as good as possible," Chaum continued, arguing many projects "gloss over" various technical issues that could break or undermine a project.

Yet, there's a similar skepticism on the part of crypto enthusiasts investigating Chaum's promises. A notable example is when the pseudonymous cryptocurrency blogger WhalePanda dug up the Elixxir website prior to today's announcement, expressing concerns about what he found.

While Elixxir claims to boost privacy, WhalePanda argued that requiring participants to send their name and location in a "KYC form" runs counter to those goals.

But with the technical brief now released, the broader community will be able to determine whether the breakthroughs are actually that, or whether there are bumps in the system.

All in all, though, while the project is currently focused on payments, Chaum believes Elixxir could play an even bigger part in ensuring more people have control over their data online.

"The bigger aim is to create the expectation of the broader public for fundamental human rights – digital rights in their ability to control all these aspects of their digital lives," he told CoinDesk, concluding:

"Cryptography is the only thing that can give power to the individual in the Information Age."

Revolutionary around the corner

Decentralized exchange startup Radar Relay has announced that it has added support for the Ledger hardware wallet.

In a post published Wednesday, the Øx order book provider announced the integration with Ledger, allowing people who use the hardware to transfer ether (the cryptocurrency of the ethereum network) or supported ERC-20-based tokens directly to another Ledger wallet.

The move is notable as it marks one of the first instances where a decentralized exchange allows users to trade funds directly from one hardware – that is, physical – wallet to another. Radar Relay is already integrated with the browser-based wallet MetaMask.

Ledger wallet owners can connect their devices to their computers, open their ethereum apps, and then use the Radar Relay app to send funds as needed. From there, users can choose their gas prices and tokens, and transfer their coins using the Radar app.

Thus far, the integration has won plaudits from some quarters of the cryptocurrency community. Responses to Radar Relay's announcement were primarily positive, with Twitter users calling the move "amazing" and "a glimpse of the future."

Radar Relay is built on top of the 0x protocol, first introduced last year, which seeks to facilitate fee-less transactions on the ethereum blockchain. 0x formed as a non-profit, as well, in order to encourage users to begin using the protocol. In August, 0x raised $24 million in an initial coin offering (ICO).

The move comes just under a month after RadarRelay raised $3 million in venture funding.

Tuesday, September 11, 2018

Bit Coin - the world of zero leverage versus the world of leveraged up the ass

People often wonder why a cryptocurrency with a limited supply like bitcoin has been gaining traction over the years. Since the 2008 financial crisis, the world’s central banks have printed around $12-30 trillion worth of promissory notes, and more than $10 trillion in negative-yielding global bonds. However instead of the newly printed money helping global citizens, many complain that methods like quantitative easing (QE) were not distributed properly. People believe the central banks created hyperinflation and a large imbalance of income inequality because all the funds were given to the banker’s friends — The money never trickled down to help the world’s citizens.

The 2008 QE Domino Effect: The Boom Has yet to Bust

Back in 2007, the US subprime mortgage market started collapsing because many large financial institutions were selling homes to people who couldn’t afford them, and the bankers played a game of derivatives roulette with the bunk mortgage notes. Soon enough the US subprime mortgage market exploded and it initiated an international banking crisis soon after Lehman Brothers crumbled on September 15, 2008. After Lehman Brothers buckled, bureaucrats worldwide began clamoring to the central banks to help them during the economic disaster. Politicians urged banks to stimulate the economy with a process called quantitative easing (QE). Essentially the central banks stemming from the US, Eurozone, the UK, Switzerland, Japan, and Sweden printed lots of fiat reserves for large-scale asset purchases like government bonds.

Instead of helping global citizens QE allowed the central banks to further divide economic inequality and caused many countries to suffer from massive hyperinflation. From 2008 to 2017 the world’s banking cartel printed over $12-30 trillion dollars worth of fiat, initiated hundreds of interest rate cuts, and created over $10 trillion in government bonds out of thin air. The truth is no one knows exactly how much the central banks have printed and handed out to their friends. Research from the University of Missouri estimates the Federal Reserve printed $29 trillion in fiat and gave it all to the central banking cartel and special interests.

Because of the QE practices, the creation of overabundant and mismanaged monetary assets accelerated inflation in many different countries. Now in 2018 areas like Venezuela, South Sudan, Suriname, Zimbabwe, Argentina, Egypt, Sierra Leone, Azerbaijan, Haiti, Ukraine, Kazakhstan, and Nigeria are all suffering from rising inflation and manipulated financial markets. Now in 2018, in contrast to the hardships taking place in these countries, the US dollar, the housing market, and the global stock and bond markets are considered to be forming a massive bubble again. Some economists are predicting another economic bubble pop similar to or worse than the 2008 financial crash.

The Bureaucrats and Central Banks Have No Power Over a Decentralized Electronic Peer-to-Peer Cash System

Like a psychic Satoshi saw all of this coming and predicted the effects of quantitative easing in the genesis block when he described how Chancellor Alistair used the crisis and false claims in order to bolster the idea of massive money printing and large-scale asset purchases. The message inside the genesis block’s coinbase parameter states, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Satoshi’s cryptic message in the Bitcoin genesis block explains that fiat currencies are subject to manipulating bureaucrats breaking the rules of economics for short-term recovery and spreading the world’s wealth to only a chosen few. With a better distribution process (the limit of speed or difficulty to mine newly minted coins) and a limited supply (21M), Bitcoin is meant to be different than today’s financial system where politicians can change things on a whim by using provocative media campaigns and an over-hyped economic crisis.

The Rise of Political Dissent, Occupiers, Activists, and a Band of Misfits Pushing Nerd Money

Some people realized rather quickly how horrible the wealth inequality was a few years after 2008 when thousands of protesters worldwide initiated the Occupy Wall Streetprotests. However, most people don’t know the extent of how much damage politicians and central banks have caused because we haven’t seen a severe financial crisis since 2008. But many people believe the countries like Venezuela suffering through hyperinflation is a sign the bubble will soon burst. Usually, during a financial crash ‘smart money’ moves their funds into assets like precious metals that offer a more reliable hedge against inflation. When the next crash appears society will see if Bitcoin can actually be useful as a hedge against hyperinflation. Many people believe individuals will seek out a hedge using Bitcoin, and the hard money will ultimately be used to battle against the failing monetary processes initiated by the world’s overlords.

The libertarian evangelist and former congressman Ron Paul believes quantitative easing and now ‘quantitative tightening’ has spurred the popularity of cryptocurrencies exponentially. Paul thinks the world’s central banks and the US Federal Reserve, in particular, are to blame.

“I think it’s going to continue to do exactly what it’s doing. It’s going higher and it’s going lower,” explains Ron Paul on CNBC last December. “We can look at what’s happening now, which to me is a climactic end of QEs.”

I think cryptocurrency is a reflection of the disaster of the monetary dollar system — I think if you had not had the QEs, and the massive amount of inflation, and places looking for the easing dollars to go, you might still have the cryptocurrencies. But I don’t think you would have this exponential bubble that is going on.

Bitcoin Is Not the Solution to All the World’s Economic Woes — But the Technology Will Help Society ‘Gain a New Territory of Freedom for Several Years’

We don’t know when the bureaucrats and the political demagoguery will run out of options and monetary magic tricks, but we do know there is a superior system available today. There are already signs of people flocking towards Bitcoin’s ‘Plan B’ in many of the countries suffering from hyperinflation, capital controls, and demonetization. However, Satoshi explained that Bitcoin is not the complete solution to society’s monetary and political problems, but emphasized Bitcoin is still a powerful tool that can help economic freedom going forward.

“You will not find a solution to political problems in cryptography — But we can win a major battle in the arms race and gain a new territory of freedom for several years,” Satoshi explained on November 7, 2008, before the codebase was launched.

Governments are good at cutting off the heads of a centrally controlled networks like Napster, but pure P2P networks like Gnutella and Tor seem to be holding their own.

What do you think about Bitcoin being used as a tool to fight for more economic freedom and fight against the demagogues who manipulate our economies? Let us know what you think in the comment section below.

Monday, September 10, 2018

Sign Message – How to sign a message with a Bitcoin, Litecoin Address

Our main intention is to build Coin Guides as a largest resource site for Bitcoin, Blockchain and Cryptocurrency. Not just for beginners, but we want users of all kind to find reliable resource from this website. Recently we’ve posted several wallet setup guides for beginners without explaining in depth features of what one can do with a crypto currency wallet address. Here this article is going to explain one cool function that you can do with your wallet address known as sign message. What is sign message? How sign messages work? And how to sign a message with your Bitcoin, Dash, Litecoin, Monero and basically any alt coin addresses.

What is a sign message? Wallet Signing – Digital Signatures

Digital signature is a mathematical way of authenticating documents and digital messages. The signing mechanism is the way of proving that a particular message or a piece of data comes from your end and not from someone else. By signing a message to your Bitcoin or crypto currency address you are demonstrating that you are the owner of the funds that a wallet holds. Also you prove that you control the private keys of the particular address

Why to sign a message?

Sign message is a kind of ID system to prove the ownership of Bitcoin or crypto currency address. There are many scenarios in which signing a message will be beneficial.

Let’s say you want to show the amount of Bitcoins to your friends or a third party which you hold in your wallet. You can simply provide them your public address and they can check it in block explorer. It will show your transaction details and the amount of Bitcoins your wallet holds. However it doesn’t prove that you are the owner of that address.

Blockchain and crypto currency are transparent so basically using block explorer you can check the balance and transaction details of any wallet address. So your Friends or third party won’t believe that the wallet address is yours until unless you prove them.

The only way you can be certain for yourself that you have full control of your own wallet is by owning the private keys. However private keys should never be shared to anyone to prove the ownership. This is when message signing and verification feature helps you. Without revealing your private keys you can prove the ownership by sharing your wallet signature.

Wallet signatures also largely helpful in ICO’s. For example Ethereum is well known for smart contracts so to purchase tokens vendors will ask for ETH as a payment. Before sending you the tokens third party needs to verify that you are the actual person that sent ETH. You can prove them by sending your wallet signature along with the a custom message. With this signature third party can verify the ownership. Hence the deal becomes transparent.

How to sign a message?

There are several types of wallet available. 1. A PC version, core wallet which directly access the blockchain (QT wallet), Multibit. 2. A third party online wallet ( Blockchain.info ). 3. Hardware wallet (Trezor / Ledger wallet ). 4. Electrum Wallet. 5. Mobile wallet ( Coinomi ). Whatever the wallet type is you’ll find wallet message signing and verifying feature somewhere in the interface.

Basically message signing and verifying feature contains three fields.

- A field to enter your wallet address (public address) for which you’d like to create a signature.

- A message field where you can enter your custom message.

- A signature field which auto generates a encrypted string based on your wallet address, private keys and custom message.

Sign messages can be implemented not just on Bitcoin, Litecoin, Ethereum, Dash and Monero addresses. Basically in all crypto currency you’ll find this feature. Here we’ll guide you where and how to use this feature in electrum and QT wallet.

Bitcoin Electrum Wallet – Sign/Verify Message

In your Bitcoin Electrum wallet go to Tools >> Sign/Verify Message which will open a pop up consisting three fields. Enter your public wallet address for which you wish to sign along with your custom message. Once done click on sign which will generate a signature.

Pic Credit: https://bitcointalk.org/index.php?topic=990345.0

To verify the ownership of the wallet address you can share all three info that is your address, message and signature. The recipient then enters the provided information using his client and verifies the ownership. Simple isn’t it.

Signing a message using QT wallet

In QT wallets you’ll find this wallet signing feature either under file, settings or tools. Here for this example we’ve used Trezarcoin wallet. In Trezarcoin wallet its under Tools >> Sign message. You’ll get the window pop up consisting the three fields.

Signing Messages using Trezar wallet

Trezar wallet is the most secure wallet to hold crypto currencies. If you own one and looking to sign or verify a message using Trezar hardware then we suggest you to check their official guide.

Few wallets like JAXX for example don’t offer this sign message option. In such case you can import the wallet from JAXX to Electrum and then create a sign message.

Wallet signing is not only used for verification purpose. It can also help you to recover your exchange account in case if your lost your 2FA access. We hope you find this wallet signing feature useful. What do you think? Have you signed your address before? Share your thoughts and ideas.

Subscribe to:

Posts (Atom)